Trade Size and Expiration from Strike Price!

Options have been around a very long time and binary options are not really a new concept at all. The difference is in the speed, traditional options are generally weeks to years, binary options are right down to 30 seconds. Some of you may be familiar with options trading and some of you may not, in this lesson we will take a quick look at how they work.

When you prepare to take a Binary Options trade you will need to set your trade size (risk) and also choose your expiration time for the trade. Once you execute your binary options trade you will have your strike price. For the sake of this introductory example we will use the most common type of binary options trade which some brokers refer to as high/low, and others refer to as rise/fall or call/put or even just up/down. There may be other references from other brokers but these lessons will focus on the binary options brokers recommended by ElectroFX.com.

Will Price go Up or Down?

No matter what your chosen binary options broker is calling the trade, it is as simple as deciding if the price of the asset you are following will go up or down. If you think price will go up then you next need to decide for how long followed by how much you will risk. Once you execute your trade you will get the strike price, then need to close above it after your chosen time duration completes. For this example we will use the following interface (others will be covered later). A risk amount is entered and either high or low is selected, the buy button executes the trade and gives you your strike price.

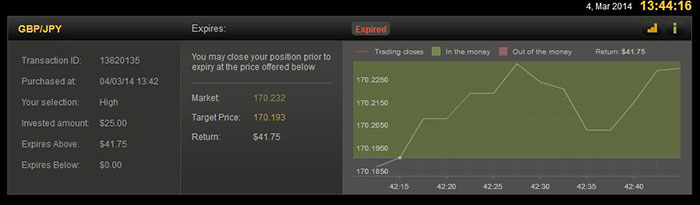

In this next image the GBPJPY is selected to go up for the next 30 seconds, the risk on the trade is $25 and the executed trade time was 13:42:13. Price must close above the strike price at 13:42:43 in order to win the trade. If price closes below the strike price at 13:42:43 then the initial investment/risk will be lost.

The above image shows you the strike price, how long until the option expires, how much your initial investment/risk was, and how much the return will be if you are correct. Each broker has a slightly different interface but with this one the chart stays green when you are in the money, and turns read when you are out of the money. It doesn’t matter if price is 1 or 50 points above the strike price at expiration in order for the trade to win. The same applies to the other side of your strike price, it doesn’t matter if price is 1 or 50 points below the strike price at expiration in order for the trade to lose.

This next image is from 89 seconds after the trade had expired. You can see in this example that price stayed ‘in the money’ for the entire duration of the trade. Once the trade completes the money goes in to your account.

If you believed that the GBPJPY was going to go down and not up then you would select low instead of high, nothing else would change. Without the correct training it is pure gambling with 30 second options and this is not the ideal start place for you. Please don’t try this unless you are comfortable reading order flow and, in general, price action.

Is it Really That Simple?

It really is that simple when it comes to how the act of binary options trading plays out, there is nothing more to it. Just don’t get too excited yet because all this means is that you can lose your money faster if you don’t know what you are doing. Let’s move on the next lesson so you can start to understand the pros and cons between binary options trading and Forex trading.