A More Common Style and Another Easy Interface

This next style of binary options broker just uses a trade size value that is your risk. This is the most common way of doing things that you will see with most binary options providers. The outcome will be no different from the previous style that was explained and after this lesson the difference will be clear.

Broker Style B – Using Risk “Amount” as a Value to Size Trades

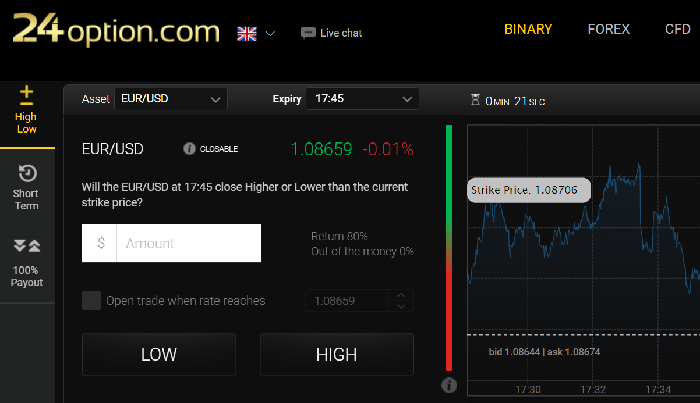

All of the binary options brokers out there are very easy to use, this next style asks you to enter a numeric value that will be the risk you are allowing on the trade. This style of broker does not have such dynamic return percentages like the previous style, the returns do still vary occasionally but it is subtle and not so frequent. This broker has chosen to call the up/down trades by the name of high/low when they are using an over 5 minutes expiry, and ‘Short Term’ when they are using a 5 minutes or below expiry.

This broker has set periods of time for you to chose from when deciding the duration of your short term trade, this can be 30 or 60 seconds, 2 or 5 minutes, and then continues up from there as high/low trades on a separate tab of the interface. On the lower section of this interface you will find the tabs where you can choose the duration of your trade, on the left half of the upper section of this interface you will enter your chosen risk for the trade, after you have done that you will see everything else you need to know just underneath. The expected return on the trade is displayed in both dollar and percentage values. The small chart on the right half of the screen allows you to watch your trade outcome live.

***Trading binary options involves substantial risk and may lead to loss of all invested capital

Once you are ready to make your trade and have entered your risk amount all you need to do is click either the ‘High’ or the ‘Low’ button, then click the ‘Buy’ button, and it is as simple as that. From that point forth you either win or lose but there is nothing further for you to do other than wait the chosen duration of time. This broker has named the trade size input “Amount:” which is your maximum risk on that trade.

Broker style B – Low Risk Martingale Application

If you have decided to use the martingale approach then the numbers are used in the same way as presented in those lessons. If you have not yet read about why and when you might want to do this go back and read the Binary Options Strategy Part 1 and Binary Options Strategy Part 2 lessons.

Let’s take a look at a table so that you can see how it works one more time, since this broker allows a minimum trade size of $24 we will start with that. You will be able to see the minimum risk that you can start your binary options trading experience off with this broker. The word “Amount:” is used in the table below where it is the value you would enter.

| 70% Return Based | Risk $25 for $42.50 | Risk $30 for $51 | Risk $40 for $68 |

|---|---|---|---|

| Initial Trade Size | Set Amount: $25 | Set Amount: $30 | Set Amount: $40 |

| Martingale 1 | Set Amount: $60.72 | Set Amount: $72.86 | Use Amount: $97.15 |

| Martingale 2 | Set Amount: $147.46 | Set Amount: $176.95 | Set Amount: $235.93 |

| Wins Needed | 14 | 14 | 14 |

| Losses to Lose | 3 | 3 | 3 |

| Session Profit/Loss | $233.18 | $279.81 | $373.08 |

Down to the $0.01 level these numbers have been kept exact but are always based on a 70% return. With this broker 70% is the usual return on 60 second trades, 67% is normal on the 30 second trades, on other trades there are other standard returns. Depending on which type of trade you settle in to will depend on your usual return percentages and you may need to recalculate to keep your numbers in check. This next table shows you your possible win/loss based on 5 sessions so if you traded once per day then this would be 1 week. If you traded twice per day then you would double this for the week and base around 10 sessions.

| 5 Sessions | $233.18/Session | $279.81/Session | $373.08/Session |

|---|---|---|---|

| 0 Session Loss | $1165.90 | $1399.05 | $1865.40 |

| 1 Session Loss | $699.54 | $839.43 | $1119.24 |

| 2 Session Loss | $233.18 | $279.81 | $373.08 |

| 3 Session Loss | -$233.18 | -$279.81 | -$373.08 |

| 4 Session Loss | -$699.54 | -$839.43 | -$1119.24 |

| 5 Session Loss | -$1165.90 | -$1399.05 | -$1865.40 |

Broker style B – High Risk Martingale Application

If you wanted to take things a little further then adding an extra level of martingale requires 34 wins per session, it only really makes any sense that a session is a day so let’s run those numbers with this style of broker.

| 70% Return Based | Risk $25 for $42.50 | Risk $30 for $51 | Risk $40 for $68 |

|---|---|---|---|

| Initial Trade Size | Set Amount: $25 | Set Amount: $30 | Set Amount: $40 |

| Martingale 1 | Set Amount: $60.72 | Set Amount: $72.86 | Use Amount: $97.15 |

| Martingale 2 | Set Amount: $147.46 | Set Amount: $176.95 | Set Amount: $235.93 |

| Martingale 3 | Set Amount: $358.12 | Set Amount: $429.73 | Set Amount: $572.98 |

| Wins Needed | 34 | 34 | 34 |

| Losses to Lose | 4 | 4 | 4 |

| Daily Profit/Loss | $591.30 | $709.54 | $946.06 |

These numbers remain exact right down to the $0.01 level and are based on a 70% return once again. If your percentage returns are different then just make sure you recalculate and keep the numbers in check. Remember, the extra level of martingale brings an extra level of trading psychology with it!

| 5 Days | $591.30/Day | $709.54/Day | $946.06/Day |

|---|---|---|---|

| 0 Day Loss | $2956.50 | $3547.70 | $4730.30 |

| 1 Day Loss | $1773.90 | $2128.62 | $2838.18 |

| 2 Day Loss | $591.30 | $709.54 | $946.06 |

| 3 Day Loss | -$591.30 | -$709.54 | -$946.06 |

| 4 Day Loss | -$1773.90 | -$2128.62 | -$2838.18 |

| 5 Day Loss | -$2956.50 | -$3547.70 | -$4730.30 |

Broker style B – Conclusion

This style of entering a trade size value that is just your risk is the same style that you will find at most binary options providers. What we like best about this brokers interface though is that it automatically shows you your trade outcome live on a chart in a color coded format. The returns at this broker are generally much lower than that of the style A broker covered in the previous lesson, but the returns are much more stable and don’t change dramatically like they do with the style A broker. That at least means you have one less thing to think about but your best course of action would be to have an account at each. This would allow you to enjoy the much higher returns of the broker style A for most for most of the day, then switch to broker style B whenever you see those returns dropping too low. If you are just getting your feet wet then broker style A will make more sense to you as they allow a much lower minimum trade size.