Different Interfaces and Different Styles

When looking in to binary options brokers you will run in to several different interfaces and also different ways of sizing your trades. This is not unlike Forex where there are also many different platforms but with binary options the different options are all very easy to learn. In this and the next lesson you will learn about 2 different binary options interfaces and also 2 different styles of sizing your trades. This first style is where you enter a number value that is the sum of the risk and the reward, this is called the “Payout”. The second style of trade sizing will be covered in the next lesson, it is a much more common and widely use method where you just enter a number value that is your maximum risk. Both styles are easy once you understand them and the outcome is always going to be the same no matter which one you choose.

*Update Oct, 2014* The broker used for the following examples now also allows you to set your stake amount on any given trade. You now have the option of doing things as outlined below or as outlined in the Broker Style B lesson that comes next. The broker used in this example is by far the most flexible Regulated Binary Options Broker on the planet right now. Visit them by clicking here.

Broker Style A – Using “Payout” as a Value to Size Trades

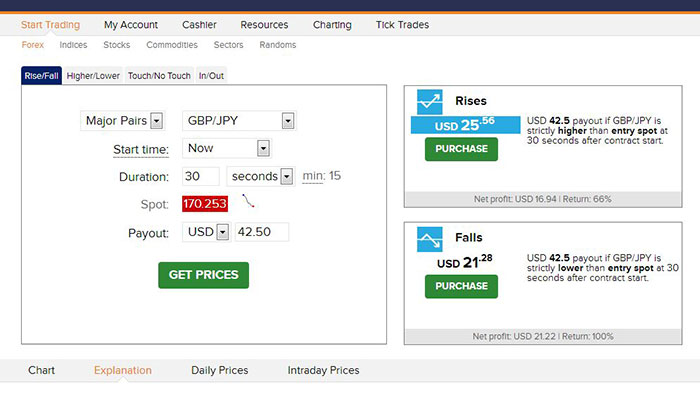

The first style of binary options broker that we will look at asks you to enter a numeric value that will be the payout you are after. The reason this broker does things that way is because it has fluctuating returns that reach up to 100% on the up/down trades. This broker has chosen to call these up/down trades in their own way and calls them rise/fall trades.

This broker also allows you to manually enter the duration that you want your rise/fall trade to be, this can be anywhere from 15 seconds right up to multiple days. On the left section of the interface you will enter your chosen duration and payout for the trade, after you have done that you will see everything else you need to know over to the right. The risk/cost of your trade required to obtain your chosen payout is displayed just above the ‘Purchase’ buttons, the profit amount in numeric value and the the returns are displayed just below the ‘Purchase’ buttons.

When you are ready to make your trade you will just click the corresponding ‘Purchase’ button for either rise, or fall, and it is as simple as that. From that point forth you either win or lose but there is nothing further for you to do other than wait the chosen duration of time. This broker has named the trade size input “Payout:” which includes your risk and return.

Broker style A – Low Risk Martingale Application

If you have decided to use the martingale approach then the numbers you will need to use are slightly different. If you have not yet read about why and when you might want to do this go back and read the Binary Options Strategy Part 1 and Binary Options Strategy Part 2 lessons.

Let’s take a look at a table so that you can see how it works and since this broker allows a minimum trade size of $1 we will start with that. You will be able to see just how low of a risk you can start your binary options trading experience off with to get your feet wet. The word “Payout:” is used in the table below when it is the amount you would enter.

| 70% Return Based | Risk $0.59 for $1 | Risk $10 for $17 | Risk $25 for $42.50 |

|---|---|---|---|

| Initial Trade Size | Set Payout: $1 | Set Payout: $17 | Set Payout: $42.50 |

| Martingale 1 | Set Payout: $2.43 | Set Payout: $41.29 | Use Payout: $103.22 |

| Martingale 2 | Set Payout: $5.91 | Set Payout: $100.28 | Set Payout: $250.66 |

| Wins Needed | 14 | 14 | 14 |

| Losses to Lose | 3 | 3 | 3 |

| Session Profit/Loss | $5.49 | $93.28 | $233.16 |

These numbers have been kept quite exact right down to the $0.01 level but are always based on a 70% return. The reality with this broker is that the average return seems to range between 80-95% so we are being very conservative here. The better the returns, the lower your risk cost and higher you returns payout. This of course means that instead of needing to win 14 trades per session you can often be finished with just 10-12 wins and still keep the numbers in check. This next table shows you your possible win/loss based on 5 sessions so if you traded once per day then this would be 1 week. If you traded twice per day then you would double this for the week and base around 10 sessions.

| 5 Sessions | $5.49/Session | $93.28/Session | $233.16/Session |

|---|---|---|---|

| 0 Session Loss | $27.45 | $466.40 | $1165.80 |

| 1 Session Loss | $16.47 | $279.84 | $699.48 |

| 2 Session Loss | $5.49 | $93.28 | $233.16 |

| 3 Session Loss | -$5.49 | -$93.28 | -$233.16 |

| 4 Session Loss | -$16.47 | -$279.84 | -$699.48 |

| 5 Session Loss | -$27.45 | -$466.40 | -$1165.80 |

Broker style A – High Risk Martingale Application

If you wanted to take things a little further then adding an extra level of martingale requires 34 wins per session, it only really makes any sense that a session is a day so let’s run those numbers with this style of broker.

| 70% Return Based | Risk $0.59 for $1 | Risk $10 for $17 | Risk $25 for $42.50 |

|---|---|---|---|

| Initial Trade Size | Set Payout: $1 | Set Payout: $17 | Set Payout: $42.50 |

| Martingale 1 | Set Payout: $2.43 | Set Payout: $41.29 | Set Payout: $103.22 |

| Martingale 2 | Set Payout: $5.91 | Set Payout: $100.28 | Set Payout: $250.66 |

| Martingale 3 | Set Payout: $14.34 | Set Payout: $243.53 | Set Payout: $608.77 |

| Wins Needed | 34 | 34 | 34 |

| Losses to Lose | 4 | 4 | 4 |

| Daily Profit/Loss | $13.93 | $236.54 | $591.27 |

These numbers are once again quite exact right down to the $0.01 level and based on a 70% return. The reality with this broker of average returns between 80-95% keeps these numbers very conservative. The better the returns, the lower your risk cost and higher you returns payout. This means that instead of needing to win 34 trades per session you can often be finished with just 26-30 wins and still keep the numbers in check. The extra level of martingale brings an extra level of trading psychology with it!

| 5 Days | $13.93/Day | $236.54/Day | $591.27/Day |

|---|---|---|---|

| 0 Day Loss | $69.65 | $1182.70 | $2956.35 |

| 1 Day Loss | $41.79 | $709.62 | $1773.81 |

| 2 Day Loss | $13.93 | $236.54 | $591.27 |

| 3 Day Loss | -$13.93 | -$236.54 | -$591.27 |

| 4 Day Loss | -$41.79 | -$709.62 | -$1773.81 |

| 5 Day Loss | -$69.65 | -$1182.70 | -$2956.35 |

Broker style A – Conclusion

This style of entering a trade size value that is your risk + the reward you want may seem a little complicated at first but it is very basic math. What we like best about this broker are the high returns that are unmatched by any other broker on this type of binary options trade. The only problem is that around major news events the returns do drop down in the 50-70% range and you have to keep your eye on it. Your numbers strategy will be ruined if you start taking trades with such small returns. Just make sure you don’t forget this happens and only take trades when the returns are above 70%.