(26 votes)

(26 votes) Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineTook this CT EU short, stayed 1-1 based on a HH on the M8.

** Register Here for Free Membership to see this image/link **

VIP Members

$43

$43January 18, 2015

Offline

OfflineHey Rob, nice to see you doing so well. its a bit hard to tell where in the market you took some of them, but it's clear you are using the system most skillfully to choose your triggers.

Â

anyway set the lines for this gold buy late last night, but the tm didnt like the spread and didnt open it. think i will increase the allowed spread for gold.

** Register Here for Free Membership to see this image/link **

Â

anyway just took this sell on gold, the trend is still down, letting the trigger lead the way. there is already 3 waves up so could well be the turning point. still as it's counter trend on the larger scale i will stick to 1 to 1 rr.

** Register Here for Free Membership to see this image/link **

edited to add:

gold sell went to profit, have a feeling i could have held on for more, but i'm trying to be consistent at the moment rather then hunting for those home run type trades.

** Register Here for Free Membership to see this image/link **

hey you! remember to follow your bloody rules!

VIP Members

$43

$43January 18, 2015

Offline

Offlinehere are some scalps i took on the GU, the exits were decided by the m33 triggering the opposite way.

Â

** Register Here for Free Membership to see this image/link **

Â

as i saw the gold trigger again for another sell, i took it with the clear plan to get out if it triggers the wrong way. don't want to give back my winnings. so yeah not quite 1 to 1 rr on the second gold trade, but it gave a clear buy trigger on the tick chart, so i decided to jump out.

** Register Here for Free Membership to see this image/link **

hey you! remember to follow your bloody rules!

Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineNice Gold Short, wish I would have seen that one.  Scalps look good too.  As far as your gold trade manager EA, you need to multiply all the values by 10.  So load the TM EA, hit F7 and adjust the values.  Then on your gold M1 after you load the M1 template, right click, go to indicator settings, then to Lvl sizes, and make sure is gold is set to true. Also be careful with your lot size. You may want to stay with .05 or smaller until you get the hang of trading gold.

Moderators

Free Members

$587

$587March 1, 2011

Offline

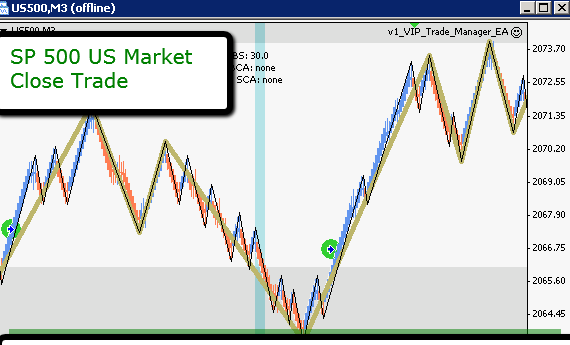

OfflineI am becoming convinced that key market time trading is the way to go. Â Just took this SP 500 US market close trade (30 minutes prior to US market close).

I need to ID a time and equity pair for the Asian session.

** Register Here for Free Membership to see this image/link **

Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineNice gold action this morning. Â Somewhat cautious though. Â These commodities have really fallen. They are due for a pullback, so keeping SL tight.

** Register Here for Free Membership to see this image/link **

VIP Members

$43

$43January 18, 2015

Offline

Offlinethats some beautiful rr you are getting out of the market. i think you are right about the time to trade, just wish i could fir the european open into my day. but you are right i find getting good trades easier during the newyork open then during asian sess.

Â

thanks for the heads up about changing level sizes to gold is true, i already remembered Theo mentioning to change all the buffers to 10x the size, so i did that now too. had done it before, but then reloaded the tm or tenplate.

seeing a really interesting situation on gold, i set my lines to take the brown trigger if it fires off a buy

Â

** Register Here for Free Membership to see this image/link **

edited to add:

so yeah the gold buy didnt trigger, it seems i some how didnt save the new spread settings lol. anyway when i checked in i saw a very nice entry, i was able to shrink the wholetrade down by using the black to enter. of course this make the stop tighter and leaves less room for error, but it also allows my to go for a closer tp still maintaining decent counter trend rr.

** Register Here for Free Membership to see this image/link **

Â

i have also had a gu buy open for a while now, not really sure if this dog will hunt as they say, it certainly isn't one of those nice fast trades. i was able to tighten my stop a bit, but not to BE yet as i want it to have room to breathe

** Register Here for Free Membership to see this image/link **

hey you! remember to follow your bloody rules!

VIP Members

$43

$43January 18, 2015

Offline

Offlinehere a trade i took on the nas100/us tec100, was a break out 1 to 1 RR sell

** Register Here for Free Membership to see this image/link **

Â

wow nice! the gold trade that i shrank down went to profit while i was out doing shopping. as it turns out i judged my original tp well as that where it went. still can't be helped, the trade i set was the safer easier to achieve target

Â

** Register Here for Free Membership to see this image/link **

Â

still waiting on the GU buy to make it's mind up, might well close it, noticed that trades that just hover around in the first 10'% of the trade seldom tend to do what you want them to.

Â

edited to add:

gu trade still open, alterating between 5 and 10 dollars of profit, market about to close and i think i will manually close it before it does close.

Â

gold trades went well, now we have a sell potentially setting up, but yeah it's no good timing wise. although i am tempted, the gambler in me says gold is good for another trip to the down side, but yeah, if i take it i will take a tinny position.

** Register Here for Free Membership to see this image/link **

hey you! remember to follow your bloody rules!

VIP Members

$43

$43January 18, 2015

Offline

Offlinehope everyone had a good week end.

Â

looks like Theo's trading desk is still under a layer of building material, lol.

Â

anyway i'm loving the system today, made a couple of sweet trades on the us500/spx500, nice sell on the way down followed by a nice CT buy

** Register Here for Free Membership to see this image/link **

Â

the gu i wanted to close early and didnt, went to BE today, before heading off to the original TP, lmao. also made a small loss on the eu.

also made a loss on gold yesterday, but more then made up for the loss with todays win. also have a gold sell open right now.

** Register Here for Free Membership to see this image/link **

Â

edited to add:

some hours later i took this CT buy on the dow jones/US30, so far so good, it's about to hit my lock profit trigger, at least i hope it is. as you can see this little beauty didnt look good at all for a while there, thankfully i took the safer SL and treated it as a 2 point turn. was a close one thats for sure, hope it hits that lock profit trigger soon, then i can relax. it's flirting with it now 🙂

** Register Here for Free Membership to see this image/link **

hey you! remember to follow your bloody rules!

Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineHere are some examples of US market close trades (30 minutes prior to US stock market close)Â

I have notice that these triggers are usually long, but not always. This usually long dynamic close to/after US markets are closed may be due to the fact that most retail traders do not have access to the markets at this time. Â The only way is to be exposed to futures, CFDs, or some post market mechanism. CFDs are banned n the US.

Because of the lower volume, algos controlled by larger firms or governments can then more easily move the markets (plunge protection team). Â Just an idea.

Here are the triggers. Â Blue line signifies 30 minutes prior to US close.

VIP Members

$43

$43January 18, 2015

Offline

Offlinethats really cool, will have to keep a look out. for some reason i cant get the eovm time indicator show the second time i set. have it set for green at eu open and yellow for the US open, but that one is not showing up on the charts for some reason.

hey you! remember to follow your bloody rules!

Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineVIP Members

$43

$43January 18, 2015

Offline

Offlinenice one Rob. nice position to be in.

took this gold sell earlier, not sure if she will work out or not at this stage

** Register Here for Free Membership to see this image/link **

Â

- had a kind of melt down and managed to lose all my hard won gains in 2 trading sessions. seem to be becoming a habbit with me, 2 steps forward followed by 3 steps back. trying to find the one rule that will up my results on back testing. i think trading time as you and Theo both talk about would help me. limit my trading to certain times of high volatility.

hey you! remember to follow your bloody rules!

Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineModerators

Free Members

$587

$587March 1, 2011

Offline

OfflineWeeMee:

I am gravitating toward key market time trading. Â Then supplementing with SP 500 / Metals trades if they surface. Â This is still in the developmental stages though.

SL just got taken out +38 on my Gold short.

The key is to pass on spot currency trades unless the conditions and patterns are ideal. Â I really only look at 1 pair now the EU. Â Less trades but more focused and only consider if I see a great entry, example: Â LL, pullback to LH, leaning ghost sell. Â 1-1 at least. Â I am drifting away from CT trades all together.

I do check my charts on the EU when I get a chance, but focus at the pre-US market open, then 90 minutes later the US market open.  Then the US market close for SP 500.  After the midway point of the US markets, I skip currencies all together unless a perfect pattern surfaces.  I took one for 34 pips on the EU on Friday.  But US afternoon trading has much better PA on the SP 500, Nasdaq, and metals.

Again still investigating, but this is better for my schedule. Â EOVM is out of the question for me. Â Too early.

Also trade conservative lot sizes. Â Forget the all in, home run trades people brag about on the internet. Â Those are 1-off trades or simply BS demo account trading.

Remember, LL pullback LH entry pattern, sell. Â HH pullback HL, entry pattern, buy. Â IF this is not the pattern, skip the trade.

Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineVIP Members

$43

$43January 18, 2015

Offline

Offlineits funny you should say that about the nas, spx500, dow and dax etc. i'm also finding them a bit easier to trade then the eu and gu. gold also seems to have an over all profit. oil is also one that can give you nice setups and good moves. i wonder if they are less easy to manipulate then the currencies?

Â

anyway that gold sell i posted above went well, i broke it up into 2 trades. the move is probably gonna go on to make a new low, but as you were saying i need to aim for decent TP's, not fantastic ones.

** Register Here for Free Membership to see this image/link **

Â

as for the CT trades, does that include trades where you have a brown trigger turning the trend?

hey you! remember to follow your bloody rules!

Moderators

Free Members

$587

$587March 1, 2011

Offline

OfflineModerators

Free Members

$587

$587March 1, 2011

Offline

OfflineTook A loss on GU -36

But SP 500 long looking good so far

** Register Here for Free Membership to see this image/link **

Most Users Ever Online: 64

Currently Online:

2 Guest(s)

Currently Browsing this Page:

1 Guest(s)

Top Posters:

koeart: 545

WeeMee: 354

fxstuntelaar: 185

Generaal_Goudvis: 141

juakali: 82

ChrisW: 81

henkknot: 70

Pepe le Pip: 58

Snejanka: 45

Gj8668: 38

Newest Members:

adminlin

Pfoozy

DutchyFX

ugochinoel

1ez1

vchimereze

Nickachino

COOPER

Michael00000

Rodj

Forum Stats:

Groups: 5

Forums: 22

Topics: 224

Posts: 2416

Member Stats:

Guest Posters: 3

Members: 2365

Moderators: 5

Admins: 1

Administrators: Theo Patsios

Moderators: cesande, glangstaff@shaw.ca, Rob S, theopatsios, sitegroundam

Log In

Log In

Home

Home

Usage Policy

Usage Policy