Forex Market Currency Distribution

The Forex Market is unlike any other financial market on the planet. It has no physical location and there is no central exchange. Forex is run completely electronically 24 hours a day and considered an Interbank market. It is for these reasons that it has grown into the massive beast that it is.

So what are the figures behind the actual distribution of all this money across the currencies? The US Dollar is not surprisingly the most traded and as the World reserve currency, it is by default, part of all the major pairs and also what commodities are valued against. In fact the US Dollar takes up a whopping 85% share of all transactions made each day which is followed by the EURO in a distant 2nd place. The EURO currently represents 17 member states and now 39% of all forex trading. The rest of the currencies fall into even lower positions on the scale but the top 7 spots all go to the major currencies. Here is a chart to put that in to perspective for you, just remember that because we are dealing with currency pairs the sum total is 200% instead of 100%.

How accurate these numbers really are is not something the average man can check, but you can see just how dominant the US Dollar really is, there is no close second.

How accurate these numbers really are is not something the average man can check, but you can see just how dominant the US Dollar really is, there is no close second.

Forex Market World Reserves

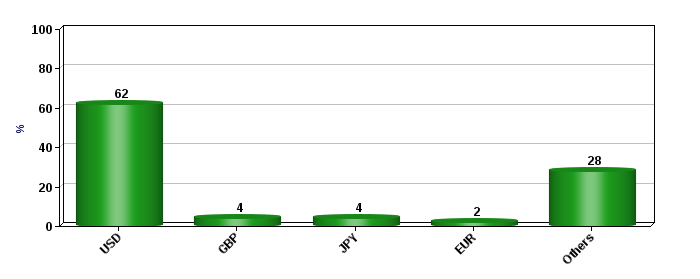

The other thing to consider with the forex market is what the actual currency reserves are comprised of. Once again the US Dollar is the top dog here and according to International Monetary Fund (IMF) makes up around 62% of the official stock pile. The average man couldn’t possibly verify this either so we are left to having to trust what we are told. It does makes sense though because of all the reasons I have already outlined above. Everyone pays attention to the US Dollar and it will probably be that way for a while. In order to put the US Dollar’s dominance in to perspective take a look at this chart showing the runners up.

It’s another clear lead for the US Dollar and we have no challengers at this time.

It’s another clear lead for the US Dollar and we have no challengers at this time.