Chart Patterns for Sideways Markets

That last types of scenario that can play out in price will form during consolidations. This is when the market has no immediate direction, or trend, and instead is moving sideways. There are only two distinct ways that this can happen and we will take a look at both in this lesson.

When the market finishes trending, or wants to take a break before continuing, it will show on your chart as a sideways movement. This is kind of like a ball dropping from height only gravity can also be reversed and so it could also happen upside down. The two ways that this can happen would be like a basketball vs a bouncy ball.

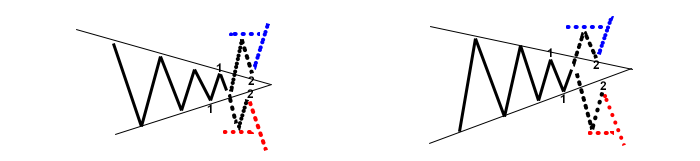

Triangle Patterns

This first pattern would be the basketball that has a good first bounce but then slowly looses its spring.

It is consecutive higher lows and lower highs that define this pattern. If the higher lows and lower highs that are being made were very close together then up to a point you may still be looking for a split double tap pattern, try not to mix them up. This pattern can be traded once price picks a direction and gets out of the triangle. The only safe way to do that is by allowing it to break out, waiting for the pullback, and using the double tap concept in a slightly different way.

Some traders will simply wait for price to break out of the triangle and jump in to to a trade. Here at ElectoFX we continue on with the repetitive theme of a double tap, in this case though you can use a mirror flip double tap, you just need proof that orders existed a price point on order for history to repeat itself. In order to do this you can wait for price to leave the triangle and return to it from the other side, you can see the 1-2 punch in the images above and would want to be be part of either the angled dotted colored waves, or the break of horizontal dotted colored waves. Look familiar? it certainly should because this is quite simply a 3-point turn style exit of the triangle.

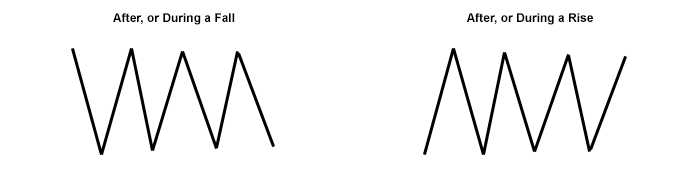

Range Patterns

This next pattern would be the bouncy ball that has a bounce which maintains itself very well.

It is consecutive equal or slightly higher lows and equal or slightly lower highs that define this pattern. Up to a point you will be looking for a split double tap style pattern, try not to mix them up. This pattern can be traded once price picks a direction and gets out of the range. The only safe way to do that is by allowing it to break out, waiting for the pullback, and using the double tap concept in the same way as the triangle.

Some traders will simply wait for price to break out of the range and jump in to a trade. Here at ElectoFX we continue on with the double tap theme and just like with the triangle you can use a mirror flip double tap here also. In order to do this you can wait for price to leave the range and return to it from the other side, you can see the 1-2 punch in the images above and would want to be be part of either the angled dotted colored waves, or the break of horizontal dotted colored waves. Once again this is quite simply a 3-point turn style exit of the range.

Chart Patterns Conclusion

The mirror flip and multi-layer styles of double tap that you have discovered in these latest two lessons can also be applied to the trend continuation waves. The chart patterns and accompanying insights that you have just discovered will now go hand in hand with the next two lessons.