The Forex Market Hierarchy

The fact that the forex market is decentralized means that there is no single price for everyone at any given time. It will depend on what broker you are using as to what price you will get. That may sound a touch chaotic but it’s actually very easy to map out the hierarchy structure that exists. No prizes for guessing who is at the top of the food chain, the major banks, these banks comprise what is known as the interbank market. These banks are the largest in the World with the odd smaller one who has made its way in. These banks often trade directly with each other.

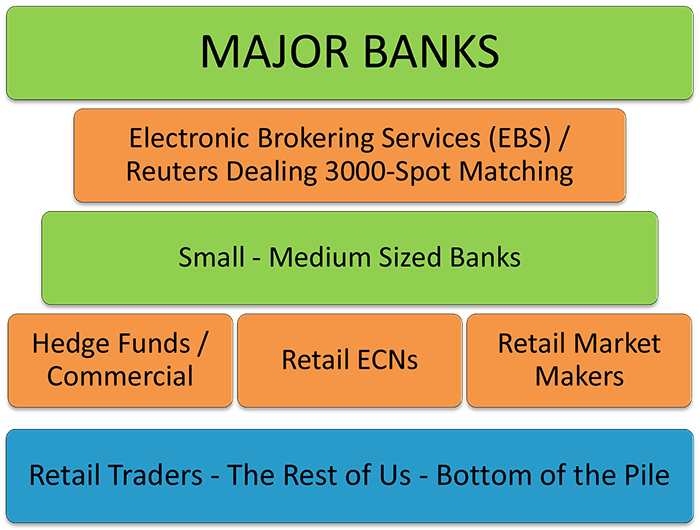

When these major banks are not trading directly with each other they will trade through the Electronic Brokering Services (EBS) or the Reuters Dealing 3000-Spot Matching. The competition between those two is very strong and together they make up the second layer of the FX ladder. Let’s take a look at an image to clarify their place.

The Big Players of Forex

The largest banks on the planet trade ridiculous amounts of money for both themselves and their clients, they make up the interbank market and end up determining the exchange rates. Governments participate in a big way due to their everyday operations and trade payments. On occasion governments will also intervene to try and manipulate their currency, Japan is famous for this and you need to beware of the JPY pairs when this is happening. Central banks have a big impact on the forex market as they try to control inflation by adjusting interest rates, they also like to try and intervene verbally when they release their statements. The last of the big market players are the large multinational corporations who are participating for the purpose of doing business globally, they have to exchange currencies constantly as products and services are bought and sold. Everyone from here on down is just a speculator and it is this group that you will be part of if you pursue this journey in to forex.

Your Place as a Retail Trader

It should come as no surprise that us retail traders are at the bottom of that ladder and it is not really worth thinking about anyway. It makes no difference to how we can trade so we just deal with it and move on. All of those major banks are part of the interbank market and get to see what prices the Electronic Brokering Services (EBS) or the Reuters Dealing 3000-Spot Matching are offering, we on the other hand just get to chose a broker or two and get what we are given. The good news is that once you learn to read the market correctly non of this will matter that much. It’s just information and there is nothing wrong with educating yourself in what you are doing.